Some Known Incorrect Statements About Pvm Accounting

Some Known Incorrect Statements About Pvm Accounting

Blog Article

What Does Pvm Accounting Mean?

Table of ContentsNot known Facts About Pvm AccountingExamine This Report about Pvm AccountingPvm Accounting Things To Know Before You BuyThe Facts About Pvm Accounting RevealedNot known Facts About Pvm AccountingThe Single Strategy To Use For Pvm AccountingWhat Does Pvm Accounting Do?

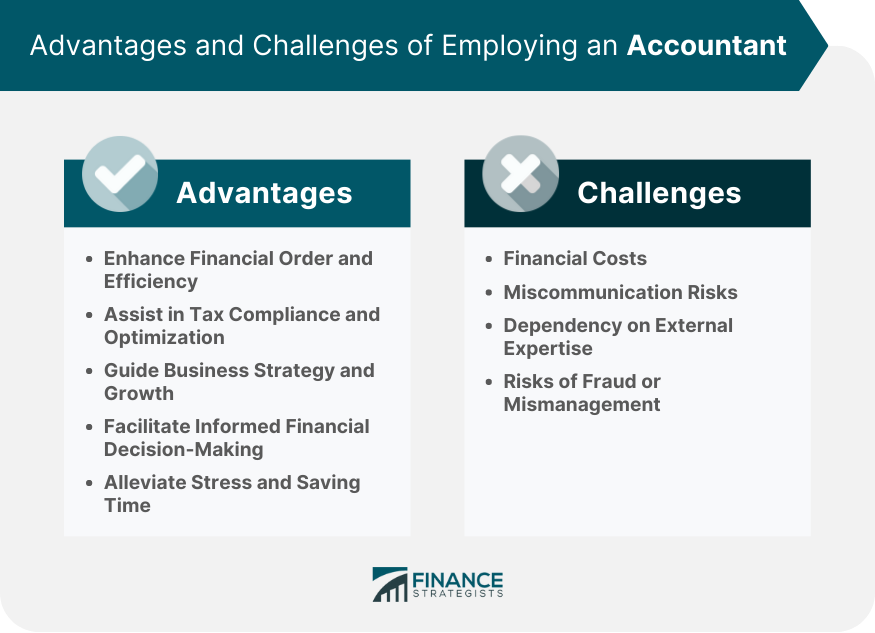

Is it time to employ an accountant? From enhancing your tax returns to evaluating finances for improved profitability, an accountant can make a big distinction for your business.

This is an opportunity to get understanding right into exactly how professional financial guidance can empower your decision-making procedure and set your company on a trajectory of ongoing success. Depending on the dimension of your business, you might not need to work with an accountantat the very least, not a permanent one. Many tiny businesses employ the services of an accounting professional only during tax time.

For instance, are spreadsheets taking control of even more and even more of your time? Do you locate on your own frustrated locating receipts for expenditures rather than concentrating on work that's closer to your core mission? If you locate yourself spending a lot of time managing your daily organization funds (think repayments, spending plans, financial reporting, expenses, and much more!) as opposed to expanding your organization, it would certainly be smart to work with an accounting professional to aid manage your audit jobs.

5 Simple Techniques For Pvm Accounting

An accounting professional, such as a state-licensed accountant (CPA), has actually specialized understanding in economic administration and tax obligation conformity. They keep up to date with ever-changing laws and ideal practices, making sure that your company continues to be in conformity with lawful and regulative requirements. Their expertise permits them to browse complex monetary issues and offer exact trusted guidance customized to your details organization requirements.

They can use you advice, such as how similar companies have successfully browsed equivalent situations in the past. Just how much is your time worth, and just how much of it are you investing in company finances? Do you frequently hang out on economic declaration prep work instead of working with organization management? Funds can be time consuming, especially for local business owners who are already juggling numerous duties - Clean-up bookkeeping.

The Definitive Guide to Pvm Accounting

Accounting professionals can manage a range of tasks, from bookkeeping and monetary reports to pay-roll handling, liberating your routine. When it pertains to making economic decisions, having an accountant's advice can be exceptionally beneficial. They can give economic analysis, circumstance modeling, and projecting, enabling you to evaluate the potential impact of various options before deciding.

Getting The Pvm Accounting To Work

They can also link you with the appropriate application groups so you understand you're setting every little thing up properly the very first time. For those who do not already have an accounting professional, it may be difficult to recognize when to connect to one (https://us.enrollbusiness.com/BusinessProfile/6699326/PVM%20Accounting). What is the oblique point? Every service is different, yet if you are encountering obstacles in the following areas, now might be the correct time to bring an accountant aboard: You don't need to write a company plan alone.

This will certainly help you create a knowledgeable monetary method, and offer you a lot more self-confidence in your monetary decisions (construction accounting). Which lawful structure will you select for your service.?.!? Working together with an accountant makes certain that you'll make educated choices concerning your firm's legal structureincluding understanding your options and the benefits and drawbacks of each

All About Pvm Accounting

Local business accounting can become complicated if you do not know how to manage it. Thankfully, an accountant understands just how to track your funds in a number of practical ways, consisting of: Establishing up bookkeeping systems and arranging financial records with assistance from accountancy software application. Aiding with money circulation monitoring and providing insights right into revenue and costs.

Evaluating costs and suggesting means to produce and stick to budget plans. Providing analysis and reporting for notified choice making. This is likely the most common factor that a small to midsize service would certainly employ an accountant.

Pvm Accounting Things To Know Before You Buy

By collaborating with an accountant, organizations can strengthen their loan applications by providing much more exact financial details and making a better situation for economic stability. Accountants can additionally aid with tasks such as preparing economic documents, evaluating financial information to evaluate credit reliability, and developing an extensive, well-structured car loan proposition. When points alter in your service, you intend to see to it you have a solid deal with on your finances.

What Does Pvm Accounting Mean?

Are you prepared to sell your organization? Accounting professionals can help you identify your service's worth to assist you safeguard a reasonable deal. Furthermore, they can help in preparing economic statements and paperwork for prospective purchasers. If you determine you're all set for an accountant, there are a couple of straightforward steps you can take to make certain you locate the best fit.

Report this page